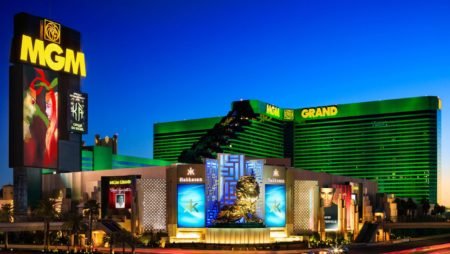

MGM Resorts International (NYSE: MGM) stock is trading lower after Morgan Stanley analyst Thomas Allen resumed coverage of the casino giant with an “equal-weight” rating.

Allen, a gaming analyst with the highest number of followers on Wall Steet, sets a $51 price target on the Bellagio operator, implying a decline of 14.6% from the November 22 close. On Allen’s call, MGM stock is lower by 2.72%, increasing a decline that has seen the share shed 15.32% from the 52-week record set early this month.

The Morgan Stanley analyst adds that while it is clear BetMGM is putting itself as a top online sportsbook and internet casino operator, there are risks if that venture cedes market share to competitors.

“MGM has been a beneficiary, with strong stock performance driven by BetMGM gaining share well ahead of expectations,”

Allen said.

“However, the share has started to fall, and we see this risk continues from increased competition with Caesars spending heavily and helped by a 60 million-plus legacy database vs. MGM 37 million and Penn National Gaming 24 million database entering new states.”

BetMGM is a 50/50 joint business between Entain Plc (OTC: GMVHY) and the casino operator. It is the second-biggest online sportsbook company in the US after FanDuel.

MGM stock sports attractive valuations

Although there are risks to consider with MGM stock, Allen states the share sport compelling valuations. According to Morningstar statistics, it trades at a price-to-book ratio of 3.06x and 2.71x sales.

Though it seeks full control of BetMGM, an MGM potential headwind was wiped out after DraftKings (NASDAQ: DKNG) recently ended its Entain courtship. With BetMGM intact at the moment, MGM does not need to search and give capital for a new technology partner, which likely would have happened if DraftKings won Entain.

MGM has long shown regret that it does not have full control of sports betting and iGaming business. Later, the casino operator was rumored to be mulling ways to gain that control while Entain and DraftKings were in discussions.

“After reviewing MGM’s third-quarter results, we have increased our fair value estimate to $42.50 per share from $39 to account for stronger demand and profitability across its US assets,”

stated Morningstar analyst Dan Wasiolek in a recent report.

“Our fair value estimate implies an enterprise value/earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBITDAR) multiple of 7.5 times our 2023 estimate, a year when we estimate travel and leisure demand to reach pre-COVID-19 demand.”

In January, the Bellagio operator offered $11.06 billion stock for all of Entain. However, the UK-based firm called the bid inadequate. Despite speculations to the contrary, the casino operator has not returned to the negotiating table.

Sports wagering: opportunity and competition

Allen’s opinion that sports betting and iGaming presents both risks and opportunities to MGM investors is spot on. Notably, some analysts believe that the big three of BetMGM, DraftKings, and FanDuel cannot sustain their current market share levels.

That implies those operators are vulnerable to rising competition. In addition, analysts and investors are becoming wary of the excessive marketing costs it takes to finish in the online sports wagering space, a factor weighing on DraftKings, as just one example.

For its part, MGM has substantial financial resources and one of the largest cash stockpiles in the gaming industry. It stands as one of the most obvious beneficiaries of expanded sports betting, which Morningstar predicts will reach 40 states and more by 2024.

BetMGM, DraftKings, and FanDuel are the top three online sportsbook operators in the US that enjoy enviable brand recognition.

Last Updated on by Ryan