LYNCHBURG, Virginia — The Virginia Merchants and Amusement Coalition (VA MAC) is protesting the governor’s decision to add more regulations to the skill gaming bill.

About 500 convenience stores from all over stopped selling Virginia lottery tickets for the day. The business owners told local news reporters that the decision would lead to many stores closing. They noted that the goal was to bring this to the attention of lawmakers and the governor.

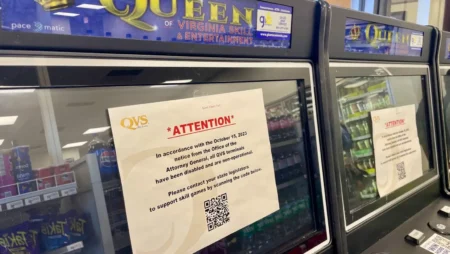

Meanwhile, convenience stores in Norfolk have closed their doors as their form of protest. Skill game machines at Race Coast Mart on E. Little Creek Road in Norfolk does not have any players, since the owners did not open their stores for business.

Many convenience store owners are critical about the amendments, stating that part of their stores’ revenue comes from citizens who visit their establishments and play on their skills games and buy lottery tickets.

Rich Kelly, president of VA MAC, stated that they have continuously requested to meet with the governor or his team for weeks, and he has ignored all our pleas.

“This is a slap in the face to the thousands of small business owners like me, who have put our lives and livelihoods on hold to advocate for skill games this legislative session. Gov. Youngkin has done nothing but ignore our small business owners and coalition in the process,” Kelly noted.

Kelly also added, “VA MAC organized two days of action to show the economic impact that the permanent closing of convenience stores will have on the Virginia Lottery, the tax revenue they generate and local economies across the Commonwealth. We feel Gov. Youngkin has put the priorities of multi-state, internationally owned major gaming corporations over the priorities of Virginia small business owners. Unfortunately, this was the only way we could make our voices heard since the Governor’s office refused to meet with small businesses on this issue.”

What are the SB 212 Amendments?

Governor Youngkin recently made dozens of amendments to the skill game regulation bill that includes the following:

- A 35% tax on skill games, up 10% from the bill’s original proposal.

- Recommendation of banning skill games within a 35-mile radius of casinos and horse racing tracks and

- A ban within 2,500 feet of churches or daycare centers.

Furthermore, Youngkin’s amendments propose the tax revenue from skill game machines be distributed as follows:

- 5% of gross profits go to the Gaming Regulatory Fund

- 5% of gross profits goes to the College Partnership Laboratory School Fund

- The remaining 25% of gross profits are split as follows (to equal 100%):

- 15% to the Department of Taxation for distribution to the locality in which the host location operates

- 2.5% to Problem Gambling Treatment and Support Fund

- 75% to the Elementary and Secondary Education Fund

- 2.5% to the Department of State Police

- 5% to the Interstate 81 Corridor Improvement Fund

The General Assembly will reconvene in Richmond on Wednesday. The chambers will be reviewing a number of amendments including the skill game regulation bill, SB 212.

Response from Youngkin

Youngkin’s office issued the following statement pertaining to the issue:

“The governor supports small business owners having access to skill games and his proposed legislative amendments, stemming from discussions with a bipartisan group of members and dozens of outside stakeholders, would establish an important regulatory framework, enhance consumer and public safety protections, and grant localities and Virginians a voice,” said Christian Martinez, Gov. Youngkin’s Press Secretary.

The office of Youngkin noted that the amendments are there to ensure citizens are protected from possible problems from engaging in gambling games too much. This means stricter regulations to ensure the well-being of the citizens when it comes to skill games.

Virginia is one of the states in the US that has legalized gambling and online casinos. But with the recent developments, it appears that legislators want to keep a close eye on gambling within their state, relegating them to casino operators who can shoulder the proposed tax increases and dissuade smaller, non-casino establishments from welcoming the idea of running gambling-related machines.

Last Updated on by jonathan r